Arctic blast threatens U.S. natural gas production, sparking price surge and winter energy concerns

01/26/2026 / By Belle Carter

- A coast-to-coast winter storm is causing freeze-offs—blockages from frozen water in pipelines—slashing U.S. natural gas output by up to 10%, particularly in key shale basins like Haynesville and Marcellus.

- Natural gas futures at Louisiana’s Henry Hub spiked 59% in a single week (Jan. 23), the steepest weekly increase since 1990, with residential utility bills expected to rise sharply in the coming months.

- The crisis mirrors the February 2021 Texas freeze, where freeze-offs caused a 45% drop in gas production, leading to mass blackouts and $130 billion in economic losses—87% of outages traced to gas shortages, not grid failures.

- Despite above-average gas inventories, prolonged freeze-offs could deplete reserves. Utilities like Entergy will pass wholesale price hikes to consumers, while Northeastern/Midwestern regions face potential supply constraints.

- While Texas has strengthened weatherization rules post-2021, other regions (e.g., Louisiana’s Haynesville Shale, Oklahoma, Appalachia) remain at risk due to unhardened equipment, with below-zero temps forecast through February.

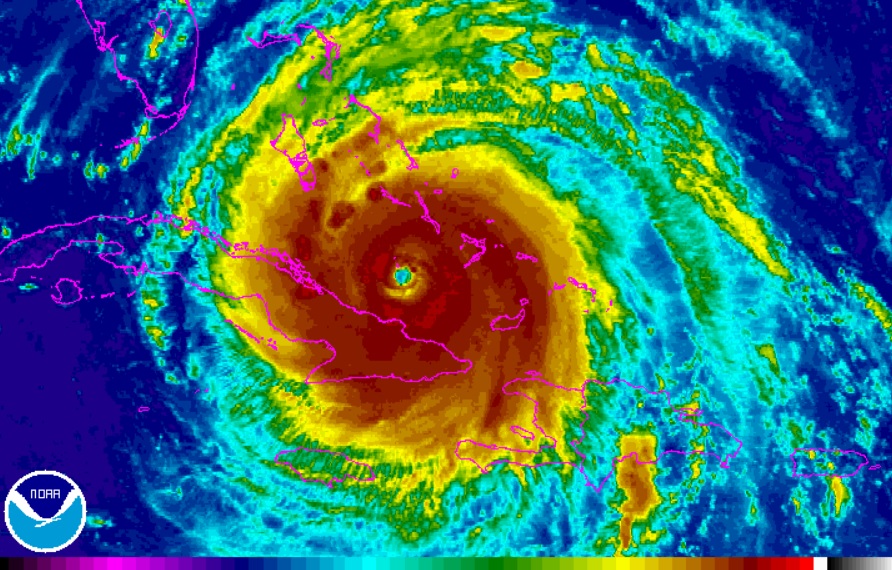

A severe winter storm sweeping across the United States is expected to disrupt natural gas production, triggering the largest weekly price surge in over three decades and raising concerns about energy reliability during extreme cold.

Analysts warn that freeze-offs—defined by BrightU.AI‘s Enoch as blockages caused by frozen water in gas pipelines—could slash daily output by up to 10%, particularly in key shale basins like Haynesville, Marcellus and Utica. Benchmark natural gas futures at Louisiana’s Henry Hub soared 59% on Friday, Jan. 23, marking the steepest weekly increase since 1990, with residential utility bills likely to reflect the spike in coming months.

The primary culprit behind the disruption is freeze-offs, where water vapor or hydrants in natural gas solidify during extreme cold, obstructing pipelines and wellheads. Price Futures Group analyst Phil Flynn noted in his market commentary: “This deep freeze is hurting production, especially for natural gas… Daily output is taking a hit, with losses soaring to as much as 10 billion cubic feet a day at peak times!”

The situation echoes the catastrophic Texas freeze of February 2021, when freeze-offs contributed to a 45% drop in natural gas production, leaving millions without power and causing up to $130 billion in economic losses. A Federal Reserve Bank of Dallas study found that 87% of Texas power plant outages during that crisis stemmed from gas supply shortages—not grid failures.

The current cold snap has already sent natural gas futures skyrocketing, with mid-February deliveries at Henry Hub reaching their highest levels in years. While U.S. gas inventories remain above average—3,065 billion cubic feet as of Jan. 16—analysts warn that prolonged freeze-offs could deplete reserves faster than expected.

Utilities like Entergy in Louisiana will pass wholesale price increases to consumers through fuel adjustment charges, though the full financial impact may not appear on bills for weeks. Meanwhile, regions relying on gas for heating and electricity generation—particularly in the Northeast and Midwest—could face supply constraints if freeze-offs persist.

Regulatory responses and infrastructure risks

Following the 2021 Texas disaster, state lawmakers mandated stricter weatherization standards for gas infrastructure. The Texas Railroad Commission’s Critical Infrastructure Division inspected 7,400 facilities last year to ensure winter readiness. However, experts warn that equipment in Louisiana’s Haynesville Shale—where wells are less cold-hardened—remains vulnerable.

RBN Energy noted that freeze-offs are also likely in Oklahoma, Colorado and North Dakota, while Appalachian producers in Pennsylvania, Ohio and West Virginia face risks as temperatures plunge below zero. The Climate Prediction Center forecasts below-normal temperatures through early February, raising fears of prolonged disruptions.

As another polar vortex tests America’s energy infrastructure, the looming question is whether lessons from past failures have been learned. While Texas has fortified its gas supply chain, other regions—particularly those unaccustomed to extreme cold—remain at risk. For consumers, the immediate concern is rising heating costs, but the broader implications touch on national energy security and the reliability of critical systems during climate extremes. With winter far from over, the coming weeks may reveal just how prepared the U.S. truly is.

Watch the video below that talks about dark winter, Texas freeze, power outages and food supply issues back in 2021.

This video is from the What is happening channel on Brighteon.com.

Sources include:

Submit a correction >>

Tagged Under:

arctic blast, bubble, Climate, Collapse, Dangerous, deep freeze, disaster, economy, electricity, energy supply, environment, freeze-off, gas prices, gas supply, market crash, money supply, natural gas production, polar vortex, power, power supply, risk, supply chain, weather, winter

This article may contain statements that reflect the opinion of the author